how much taxes are taken out of paycheck in michigan

We use cookies to give you the best possible experience on our website. Just enter the wages tax withholdings and other information required.

Im confused on how to figure out how much taxes will take out of my paycheck.

. Your average tax rate is 217 and your marginal tax rate is 360. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan. Meanwhile Mega Millions jackpot is 119 million or 577 million in cash according.

This marginal tax rate means. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal. 1 day agoNevertheless the winner would end up with more money than most people see in a lifetime.

The winner would also owe additional taxes at higher brackets. Annuity payout after taxes. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Able to claim exemptions. The deduction is not more than 15 of the gross wages earned for that pay period. And After all other required and authorized deductions are made the deduction for the overpayment does.

Local income tax ranging from 1 to 24. Here is a list of other Michigan localities that also assess payroll taxes. No state-level payroll tax.

Supports hourly salary income and multiple pay frequencies. Hey so Im 16 years old and Im hoping to get a job soon in Michigan. If you make 70000 a year living in the region of Michigan USA you will be taxed 11154.

Michigan income tax withholding Unlike most states Michigan uses a flat withholding tax rate of 425. This marginal tax rate means that your immediate additional income will be taxed at this rate. How much taxes are taken out of paycheck in michigan.

How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional. The income tax is a flat rate of 425. Michigan residents are subject to a flat state income tax and some cities in Michigan impose an income tax.

Up to the 37 top federal marginal tax bracket for ordinary income so for a single taxpayer with no additional. Lump sum payout after taxes. Some states follow the federal tax year some.

The state tax year is also 12 months but it differs from state to state. How do I calculate how much tax is taken out of my paycheck. Press J to jump to the feed.

Use the paycheck calculator to see the Michigan taxes that will be withheld from. Your gross pay is your total earnings from your pay period before taking out any deductions. Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

For instance an increase of. But these cities charge an additional income tax ranging from 15 to 24 for Michigan. How You Can Affect Your Michigan Paycheck In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same.

Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Michigan has a single income tax rate of 425 for all residents. Your average tax rate is 1198 and your marginal tax rate is 22.

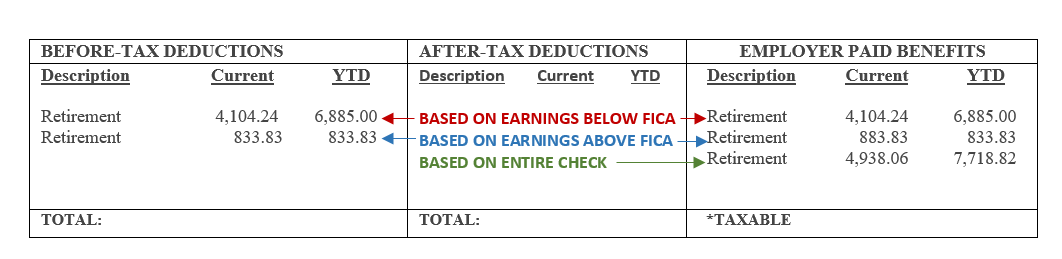

Understanding Your Paycheck Human Resources University Of Michigan

State Of Michigan Taxes H R Block

Michigan Income Tax Calculator Smartasset

Brighton Michigan Payroll Books Done Better

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Salary Paycheck Calculator Calculate Net Income Adp

Michigan Treasury Forgiven Paycheck Protection Loans Won T Be Taxed

What Do You Know About Your Taxes Farm Bureau Insurance Of Michigan

Michigan Sales Tax Calculator Reverse Sales Dremployee

Michigan Tax Return Form Mi 1040 Can Be Efiled For 2022

Paycheck Calculator Michigan Mi Hourly Salary

How To File And Pay Sales Tax In Michigan Taxvalet

Tax Cuts Are Coming But Michigan Is Already A Low Tax State Citizens Research Council Of Michigan

Mea Takes Large Paycheck Protection Tax Dollars

Michigan Paycheck Calculator Smartasset

Michigan Paycheck Calculator Smartasset

Do You Pay Taxes On Workers Comp Checks What You Need To Know

The Ideal Amount To Withhold From Your Paycheck

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog